Life Insurance

The purpose of life insurance is to cover the risk of premature death. A death benefit is payable if the life insured dies during the policy term. Life insurance policies are legal contracts where you are supposed to pay a premium for availing the coverage offered by the insurance company.

Why Do You Need Life Insurance?

1. Secure your family’s financial future

Life insurance is all about securing you and your family financially.

2. Accomplish your financial goals

We all have some goals in life that require saving money. Through life insurance plans, you can build a financial corpus and protect it with a life cover. Life insurance plans inculcate a habit of disciplined saving. Paying a small amount as an insurance premium each month will help you accumulate funds. What’s even better is that this small monthly amount only keeps growing. Eventually, you’ll accumulate enough wealth to reach your more substantial and long-term financial goals.

3. Brings peace of mind

Having life insurance will give you peace of mind. Life is uncertain, and life insurance can offer financial assistance to your family when you are no longer around. You can also plan your retirement by taking a retirement plan where you will receive a monthly income.

4. Save tax

You can claim an income tax deduction on premiums paid for your term insurance under Section 80C of the Income Tax Act, 1961, up to ₹1.5 lakh per financial year. Additionally, the death benefit received by your nominee is completely tax-free under Section 10(10D), subject to certain conditions.

Types of Life Insurance Policies

Term Insurance

A term insurance policy is a legally binding agreement between the insured and the insurer, under which a death benefit is paid to the nominee if the policyholder passes away during the policy term. In exchange for this protection, the policyholder pays regular premiums to the insurer. The coverage provided by a term plan is valid only for a specified period, which can range from 18 to 85 years, depending on the age at which the policy is purchased. Term insurance focuses purely on financial protection,

without any investment or savings component, making it an affordable way to secure significant coverage.

Why Choose Term Insurance?

In India, where families often depend on one or two earning members, term insurance plays a vital role in maintaining financial stability during unforeseen events.

Financial Security: Ensures your family continues to meet daily expenses and long-term goals like education or marriage.

Debt Protection: Helps cover outstanding loans or liabilities, so your family isn’t burdened financially.

Affordable Coverage: Offers substantial coverage at minimal cost, making it accessible for all income groups.

Key Features and Types of Term Plans

Indian insurers offer multiple plan options to fit different financial goals:

Level Term Plan: Fixed sum assured and premium throughout the policy term.

Increasing/Decreasing Term Plans: Adjust coverage to match inflation or decreasing liabilities.

Return of Premium (TROP): Get all your premiums back if you outlive the policy term.

Whole Life Term Plan: Coverage for your entire lifetime (up to 99 or 100 years).

Convertible & Limited Pay Plans: Flexibility to switch or complete payments early while retaining long-term cover.

Online Term Plans: Easy purchase with lower premiums due to reduced overhead costs.

Riders for Enhanced Protection

Boost your plan with add-on riders such as Accidental Death Benefit, Critical Illness, Waiver of Premium, or Income Benefit Rider, ensuring complete financial protection against various life risks.

Tax Benefits

Enjoy tax savings under the Income Tax Act, 1961:

Section 80C: Deduction up to ₹1.5 lakh on premiums paid.

Section 10(10D): Tax-free death benefit for the nominee.

Unit Linked Insurance Plans

Unit-Linked Insurance Plans (ULIPs) are innovative financial products that combine the benefits of life insurance with market-linked investment opportunities, making them a versatile choice for long-term financial planning. With a ULIP, a portion of your premium provides life cover to protect your loved ones, while the remaining portion is invested in a variety of funds, including equity, debt, or balanced options, helping you build wealth over time.

Key Features of ULIPs

1. Dual Benefit – Insurance + Investment

ULIPs provide life insurance protection along with market-linked investment growth. A portion of your premium secures your family financially, while the rest is invested to help you accumulate wealth over time.

2. Flexible Fund Options

Policyholders can choose from a variety of funds based on risk appetite—equity for higher growth potential, debt for stability, or balanced funds for a mix of both. This flexibility allows customization according to financial goals.

3. Fund Switching

ULIPs allow switching between different funds to adapt to changing market conditions or evolving personal goals. Most plans provide a limited number of free switches every year, helping you manage risk effectively.

4. Premium Redirection

Future premiums can be redirected to different funds, giving you greater control over your investments without altering your overall policy.

5. Top-Up Premiums

You can make additional lump-sum investments to boost your fund value, accelerating wealth accumulation while keeping your original life cover intact.

6. Partial Withdrawals

After the mandatory lock-in period (usually 5 years), policyholders can withdraw a portion of their fund value to meet urgent financial needs, offering liquidity without compromising long-term goals.

7. Tax Benefits

ULIP premiums are eligible for tax deductions under Section 80C of the Income Tax Act, 1961, up to ₹1.5 lakh per year. The maturity proceeds are tax-exempt under Section 10(10D), subject to certain conditions regarding sum assured and premiums.

8. Transparency

Insurers provide regular statements detailing fund performance, charges, and unit allocation. This transparency allows policyholders to monitor investments and make informed decisions.

9. Long-Term Wealth Creation

By staying invested over a longer tenure, ULIPs take advantage of market growth and compounding, potentially generating substantial returns for retirement, education, or other financial goals.

10. Goal-Oriented Planning

ULIPs can be aligned with specific objectives like retirement planning, children’s education, or wealth accumulation, ensuring disciplined investment while maintaining life cover.

Child Insurance Plan

A child insurance plan is an investment cum insurance plan from life insurance companies, which offers the financial security required for your child’s dreams and goals. You can use a child insurance plan to invest in the big life goals of your child like higher education and marriage. While you are building the corpus to fulfill these goals for your child, an insurance plan provides a safety cushion to the corpus in case of your untimely demise. In the unfortunate event of your passing away before fulfilling the goal,

the plan can invest the money on your behalf and give the maturity amount that you originally aimed for your child.Benefits of a Child Insurance Plan

1. A child plan will help you provide for your child’s important life goals regardless of your presence in his or her life. With life cover and goal protection options, a child plan alone is enough to protect your child’s future whether through investment or life cover.

2. Tax Benefits of child insurance plans are well known. You can reduce your taxable income by up to Rs.1,50,000 every year if you invest in child plans. The maturity and partial withdrawals from the plans are also exempt from tax.

Money Back Insurance Plan

In the case of the life insured's death, a standard insurance plan pays out a lump sum amount to the nominee of the policyholder. This is known as the death benefit of life insurance. On the other hand, a money-back policy is a form of life insurance policy that allows the insured to receive a portion of the sum assured at regular intervals rather than a lump sum at the end of the policy period. As a result, a money-back insurance policy is an endowment scheme with certain liquidity.

Benefits of Money Back Insurance Plan

1. Survival Benefit

Throughout the policy, money is paid to the policyholder every few years. The payment begins within a few years of the policy's inception and lasts until the policy's maturity.

Consider this scenario: Akash has chosen a money-back policy with a sum assured of Rs. 5 lakhs over 20 years. He will have to pay a 20-year premium and receive a portion of the sum assured at regular intervals.

Depending on the policy terms, he may receive 15% of the sum assured after the 5th, 10th, and 15th years of the policy, as a survival benefit, this is 15 X 3 = 45 % of the sum assured. He will also receive the remaining 55% of the amount guaranteed, plus any bonus, at maturity.

2. Death Benefit

In the event of an unfortunate incident, the policy nominee will receive the insurance amount. This includes the sum assured as well as any bonuses accumulated on the money-back policy.

3. Maturity Benefit

The insured individual receives the maturity benefit when the money-back plan matures, and it consists of:

a. Sum Assured: It is the complete cover amount that the insured selects at the start of the policy.

b. Bonus: This includes the insurer's declared reversionary benefits that have accumulated over time. This is largely determined by the company’s performance.

4. Tax Benefit

Section 80C of the IT Act, allows you to deduct up to Rs. 1,50,000 on account of life insurance premiums from your taxable income per year. In addition, Section 10(10)D exempts the maturity benefit of the money-back policy from income tax.

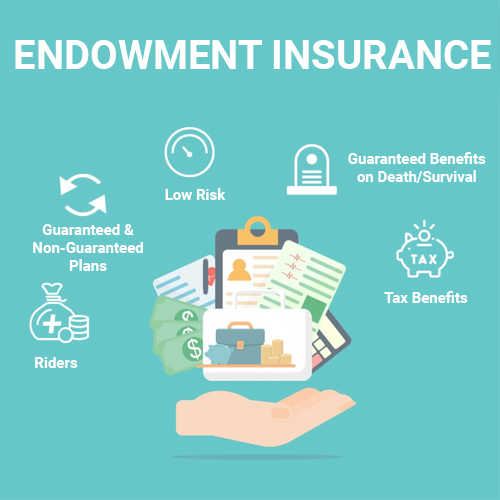

Endowment Insurance Plans

An endowment policy is a type of life insurance policy designed to pay a lump sum on maturity or death. An endowment policy can be used to build a risk-free savings corpus while providing financial protection for families in case of an unfortunate event. This simplicity of an endowment plan has over the years made it an attractive savings plan for all.

A good endowment policy provides you with the confidence to meet any financial

emergency in the future.

It provides you with returns that can help you meet your non-negotiable life goals, such as your child’s education or marriage, fulfilling the needs and aspirations of your loved ones and yourself, and more.

Benefits of an Endowment Policy

There are broadly four benefits of an endowment policy.

1. Life Insurance Benefit - Your loved ones are always taken care of. The life insurance benefit gives a lump sum pay-out, ensuring that even in your unfortunate absence your family members can continue to live the life with the same standard and dignity. This is a fixed amount and is given to your nominee/legal heir. Do remember some policies also give guaranteed additions and Reversionary Bonus which are considered in the calculation of death benefit.

2. Maturity Benefit - As long as you pay timely premiums and keep the endowment policy active, the maturity benefit is intact. This is a guaranteed maturity benefit amount that will enable you to meet your financial goals. This maturity benefit depends on the policy term, policy premium, premium payment term, age, and gender. You may get guaranteed additions on maturity in some policies. Apart from this, in participatory policies, you may also get accrued reversionary bonuses and terminal bonuses.

3. Tax Benefit - Endowment insurance plans also offer tax benefits. The premiums you will pay can help you reduce your taxable income under Section 80C of the Income Tax Act, 1961. There are tax benefits available on the maturity of endowment policies as well. This helps you save tax at the time of inception of the policy and accumulation stage, and also the maturity stage.

4. Loan Benefit -

Endowment policies can help you to get a loan. After a policy acquires a surrender value, you can take a loan against the policy. The interest charged on such loans is quite competitive. For instance, some traditional plans offer a loan amount of up to 80% of the surrender value. The loan benefit helps you arrange funds in an emergency.

5. Option to add riders - Endowment plans offer additional riders to enhance the coverage of the plan. You can add a critical illness rider, an accidental death rider, or a permanent disability rider and enjoy increased protection.

6. Low risk - An endowment policy is usually a low-risk investment. Your money grows over time with most endowment products and your returns are guaranteed.

7. Dual purpose - You get to enjoy the dual benefit of insurance as well as investment. Your savings continue to build over time and your family stays secure in the case of an unfortunate event.